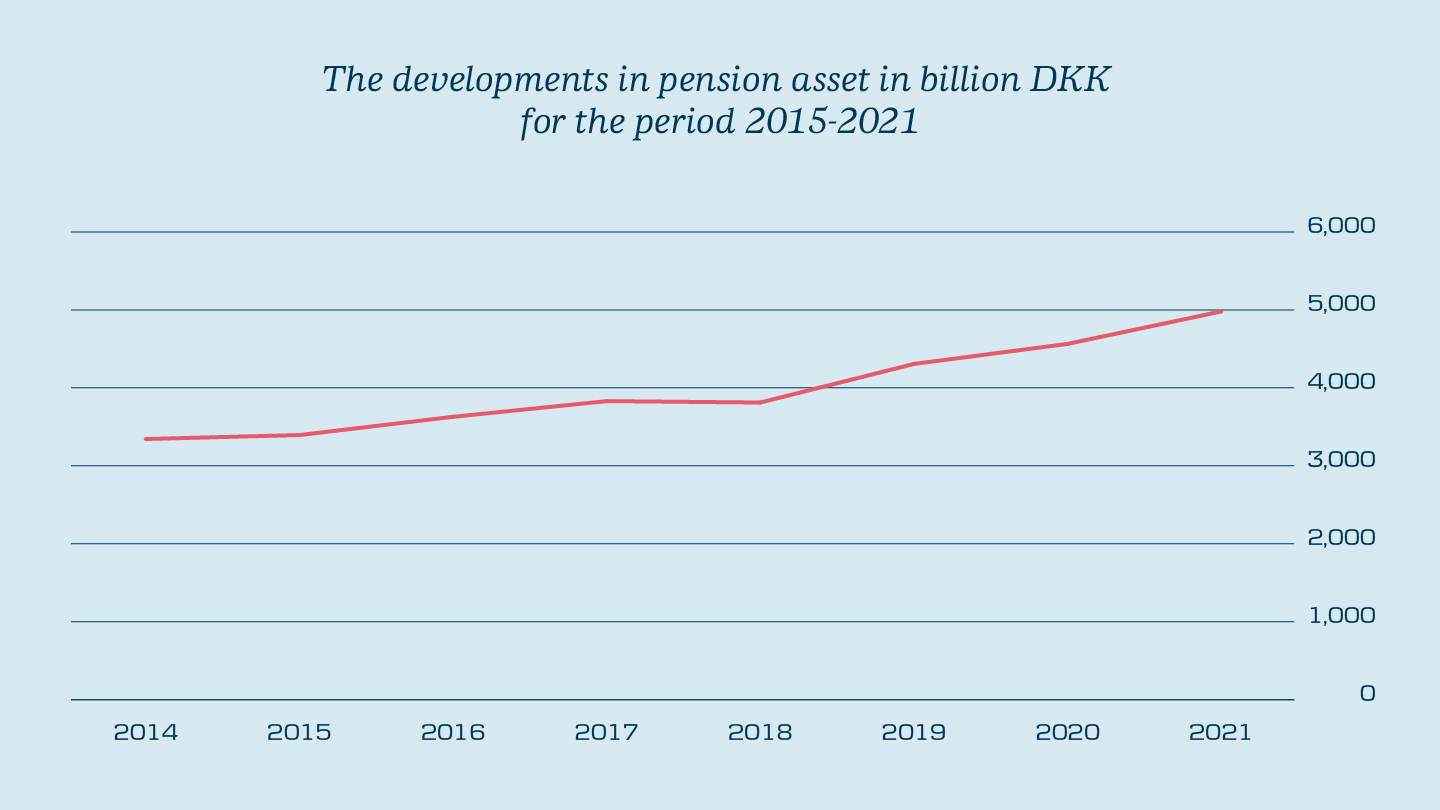

Several factors have contributed to the increase in pension savings over the past years. One key factor is that more and more people are paying into an employer-administered pension scheme alongside a general increase in the number of people in employment. This means that more people are covered by a pension scheme, and more people start saving early.

In addition, more people are paying more into their pension schemes, and pension savings have in recent years been boosted by healthy returns in the financial markets. Furthermore, factors such as rising house prices and large asset deposits in banks have also resulted in an increase in people’s other savings.

Save up to maintain your standard of living for all of your life

It is our recommendation that you save up enough to maintain your standard of living when you move from working life to retirement – and for the rest of your life. This typically requires a total lifetime coverage of 80% of your previous wage income. Your income in retirement consists of the state retirement pension, ATP, pension savings and the option to draw on any other savings you have at your disposal, including home equity.

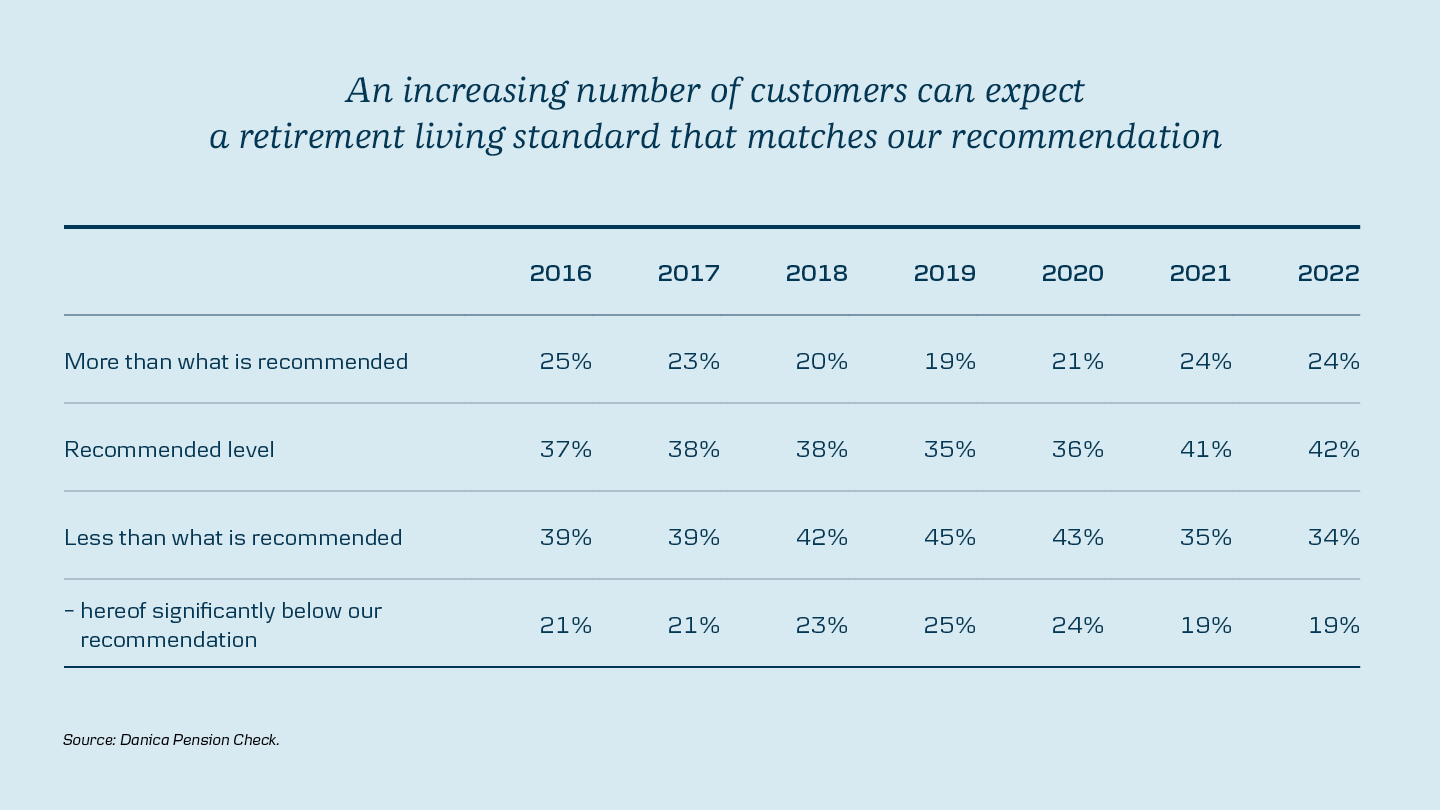

We can see that our customers in general have secured better-than-ever pension coverage prior to their retirement. And this means that they are more likely to be able to maintain their standard of living throughout their retirement years.

In 2022, almost one in four customers saved more than our recommendation. We saw the same trend in 2016. The share of people following Danica Pension’s recommendation has increased by 15% – from 37% to 42% – as shown in the table below.

And the share of people whose standard of living is likely to decrease in retirement has fallen. In 2016, a total of 39% of all customers had an expected retirement income that was lower than our recommendation, and just over one in five could expect a significantly reduced standard of living in retirement. By 2022, the share of people who could expect a reduced standard of living had fallen to 34% or a little more than one in three. This corresponds to a 12% reduction.

Another important reason for the improved coverage is the level of returns. There is a correlation between positive returns and a decrease in those who do not have adequate expected savings to maintain their standard of living in retirement. The improvement from 2020 to 2021 may also be due to the fact that 2021 was a good year in the financial markets when many pension schemes achieved significant returns.

People in Denmark are retiring later and have begun to prepare for an even later retirement

Several initiatives have been implemented that contribute in various ways to the fact that people in Denmark are retiring later and later in their lives. And our data indicates that those generations of the population that are currently active in the labour market have also begun to prepare for a retirement at an even later age.

Extending your working life by one year has several benefits. You will be able to save up for a longer period of time, obtain higher returns, and your savings will not need to cover as many years. In combination, these benefits will boost your financial situation in your retirement.

Significant financial advantages in postponing your retirement

By postponing your retirement, you gain significant financial advantages. If you are entitled to voluntary early retirement benefits and you postpone your retirement, you will be entitled to increased benefits when you do retire. In addition, you may be entitled to additional special benefits for people who continue to work beyond the state retirement age. And as mentioned above, you will be able to save up for a longer period of time, obtain higher returns, and your savings will not need to cover as many years. This means that you can get more out of your pension savings.

For all of these reasons, we recommend that you go through the Danica Pension Check to give you peace of mind that you are saving up enough for your whole life.