Advisory services

How we advise you

– so that you always have the right pension scheme

Your pension scheme is important for you and your family, today and in the future.

Our most important responsibility is to ensure that as a Danica Pension customer you always have the right pension scheme and that it gives you a sense of security. We create this security by providing proactive advice and being one step ahead.

When we have identified your needs, we will contact you directly through our advisers, our call centre, by email and by means of our online tools. We advise you in the way that best suits you – whether it be a meeting in person, by telephone or an online meeting with on-screen document sharing.

Proactive contact

– we notify you when you should take action.

We give you clear recommendations

that you can easily act on.

Digital meetings or meetings in person

– it is up to you.

Advice that fits your life situation

– our pension advisers provide unique 360-degree advisory

services covering all aspects of your family’s financial situation.

Advice when it suits you

– including Saturdays.

Are you a Danske Bank customer?

Book a meeting here, where you can meet

our experts and get a review of your finances.

Proactive advisory services

We will contact you when you should adjust your pension scheme.

Every year, the Danish population experiences more than three million life-changing events that may affect their pension schemes, and we know that our customers do not think about their pension or consider contacting us.

Naturally, it is always a good idea to contact us when you experience life-changing events that may affect your pension scheme. But we also constantly focus on developing intelligent tools and services that enable us to identify your needs before you do.

We can therefore contact you when you experience life-changing events that make it advisable for you to make adjustments.

Learn more about some of our proactive advisory services:

Learn more about our clear recommendations:

- Clear recommendations (in Danish only)

- Life-changing events

- Financial security (in Danish only)

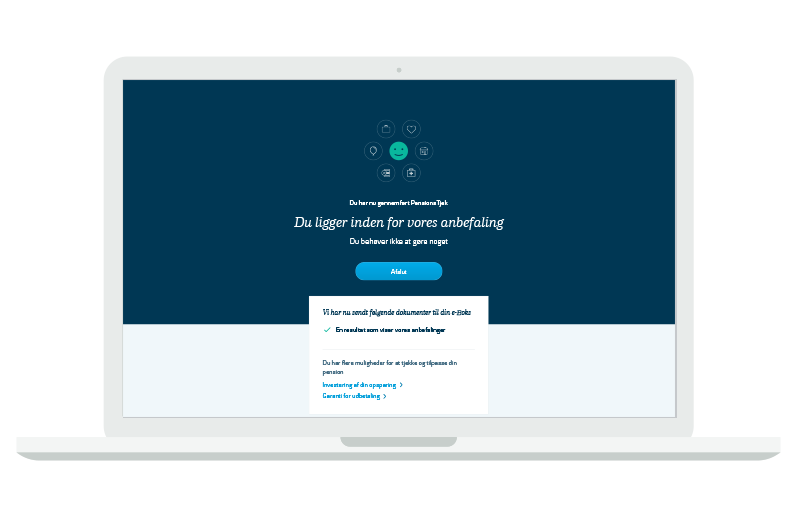

Clear recommendations

We take a stand and give clear recommendations.

Most Danes live longer and better lives today, but many also find pensions complex and confusing. We therefore give you clear recommendations to provide the financial security of having the right pension scheme.

We ensure that you get clear recommendations that you can easily act on, regardless of where and when you get advice. Our recommendations are always based on facts and analyses about our customers’ and the Danish population’s need for pensions and insurance covers. We also ensure that you have the right pension scheme in case of legislative changes, for example.

Meet us in the way that best suits you

We advise you in the way that best suits you – whether it be a meeting in person, by telephone or an online meeting with on-screen document sharing. You can call our helpline on:

+45 70 11 25 25

Monday to Friday: 8.30am – 4.00pm

You can keep track of your pension scheme in Netpension and in our Mobilpension app. You can also take a Pension Check in Netpension and adjust your scheme yourself, if necessary.

Learn more about how to meet us:

A lot can happen in a year

Take a Pension Check

Click here

Advice that fits your life situation

You are a new

customer

Advice on your pension, insurance and healthcare options.

Working life

changes

We are ready to advise you when your job situation changes.

Personal life

changes

We help and advise you when you experience changes in your personal life.

Partner advisory

services

Expertise and advice if you have special terms and conditions on your pension scheme.

Self-employed

Leading provider of advisory services for self-employed persons and collaboration with Pension for Selvstændige.

Senior advisory

services

We not only advise you on your working life, we also help you plan your finances in retirement.